Moneythink

Educating high school students on how to make and manage money

Organizations: Moneythink Univeristy of Chicago

Locations: Chicago, IL

Dates: 2009 - present

Background:

Moneythink is a nonprofit founded at the University of Chicago as a response to the 2008 financial crisis. Moneythink provides financial education seminars in underserved urban high schools.

More than two-thirds of young adults in the United States lack basic financial knowledge. Though the financial services industry spends $17 billion in marketing, the industry spends only $670 million a year on financial education. Within this already challenging context, urban youth in underserved communities also lack access to proper financial services and exposure to financial knowledge via family and peers.

Process

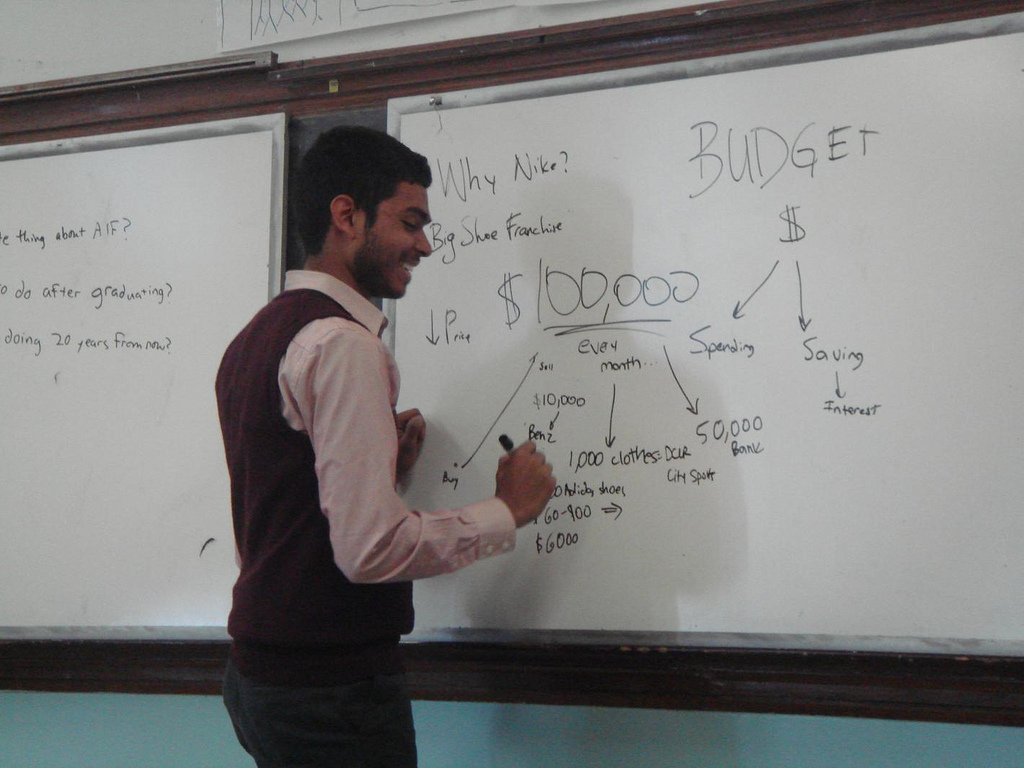

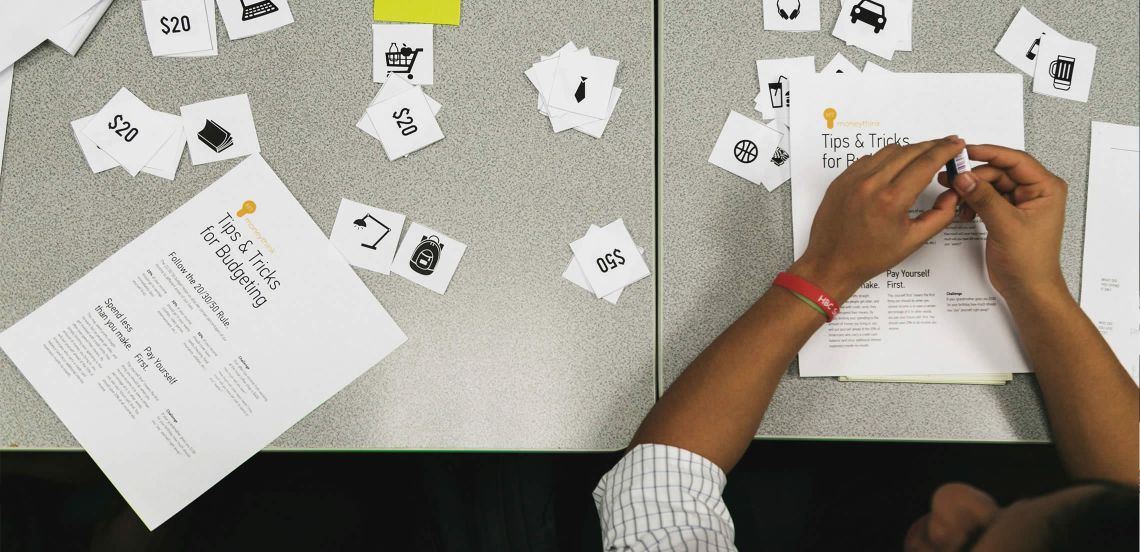

Our program started as a shoddy sketch of concepts, lessons and activities to engage students on the boring topic of money. We replaced abstract concepts with practical ideas, pop-culture references, and relatable goals. Powerful student engagement comes from peer mentorship not lectures. With this in mind, we designed our program model as a financial mentoring organization.

As we grow our UChicago organization and refine our approach, we grew a network of college campuses in parallel. By 2012, Moneythink was operating in 38 campuses nationwide.

In 2013, one year after Moneythink’s transition into a professional non-profit with a full-time staff, we convened 60 college leaders from 30 communities for the second annual Moneythink Summer Leadership Institute.

We also launched our first technology concept, Moneythink Mobile. Moneythink Mobile incorporated image-driven communication, social dynamics, and game mechanics. We raised $150,000 in funding from the Financial Health network to complete additional user experience research and finance the necessary mobile software development. For more information about the project, see the IDEO.org project profile here.

Solution

Today, we are proud to have served over 30,000 students. Moneythink currently operates with a more refined version of our initial program model. A twelve-lesson curriculum scaffolds student financial decision across three impact pillars: spending money mindfully, saving money, and using financial products safely.

The mentoring model allows college volunteers and high school students to build strong relationships, engage in meaningful dialogue, and take practical action towards their career goals. Equally important, mentoring relationships open doors to educational and occupational opportunities where program participants are linked to positive future opportunities and educational aspirations.